Understanding COBRA and ACA Marketplace Plan Options: Empowering Employees Through Transition

See your benefits at work

Navigating the complexities of health insurance coverage following a job loss, or other Qualifying Event, can be daunting for both employers and employees. The Consolidated Omnibus Budget Reconciliation Act (COBRA) offers an interim solution, allowing individuals to retain their employer-sponsored health insurance under certain conditions. However, while COBRA provides a critical safety net, it may not always represent the most cost-effective or suitable option for everyone involved.

Amidst these challenges, the Marketplace, established under the Affordable Care Act (ACA), emerges as a viable alternative, often presenting more affordable plans with comparable benefits, along with subsidized options. Understanding these options is crucial for HR professionals and benefits brokers.

At ThrivePass, we recognize the importance of informed decision-making to select personalized health coverage. Our COBRA Decision Enablement (DE) tool simplifies the comparison between COBRA and Marketplace alternatives, empowering users to make choices that best suit their needs and financial circumstances. This innovative tool not only highlights our expertise in the field, but also underscores our commitment to supporting employers and their workforce during pivotal moments of change.

Understanding COBRA Coverage

COBRA provides former employees, retirees, spouses, former spouses, and dependent children the right to temporary continuation of health coverage at group rates. This coverage, however, is only available when coverage is lost due to specific Qualifying Events such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. COBRA mandates that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families a temporary extension of health coverage (called continuation coverage) under certain circumstances.

COBRA coverage can be a lifeline during uncertain times, ensuring individuals do not lose their health insurance unexpectedly. However, it is crucial to understand the costs involved. On average, COBRA costs $599 per month, which is significantly higher than the average cost of a Marketplace plan of similar quality, which costs around $462 per month. Moreover, while 94% of people on platforms like HealthSherpa qualify for government subsidies, reducing the average cost to $48 per month, there is no such financial assistance available for COBRA premiums, making it a less economical option for many.

Source: https://blog.healthsherpa.com/cobra-health-insurance-aca-better/

Despite these costs, many opt for COBRA because of the coverage consistency it offers with their previous employer's health plan, providing a certain level of comfort and security during transitions. However, the high cost associated with COBRA can be a substantial financial burden, especially when considering it typically covers the same health services at a higher premium paid entirely by the individual, without any contribution from the employer.

For HR professionals and benefits brokers, it is vital to not only inform departing employees of their COBRA rights, but also to help them understand these rights in the context of their personal circumstances and other available options. This will ensure they make informed decisions that reflect both their healthcare needs and their financial capabilities.

The Affordable Care Act Marketplace as an Alternative

The Affordable Care Act (ACA) Marketplace offers an array of health insurance plans that can serve as viable alternatives to COBRA, especially for those seeking more affordable options. The Marketplace is designed to facilitate the purchase of health insurance in state-level exchanges, providing a variety of plans with different levels of coverage and cost.

One of the primary advantages of the ACA Marketplace is its financial accessibility. Not only are Marketplace plans generally less expensive than COBRA, but a significant portion of individuals qualify for subsidies which can further reduce the cost. Research indicates that "80% of people will usually qualify for financial help from the government (called a subsidy) to help pay their premium," making these plans more accessible to a broader demographic. Furthermore, those who purchase insurance through HealthSherpa find that after subsidies, the average cost can be as low as $48 per month, a stark contrast to the $599 monthly average for COBRA coverage.

Source: https://www.ambetterofnorthcarolina.com/learn-more/cobra-vs-health-insurance-marketplace-faq.html

Source: https://blog.healthsherpa.com/cobra-health-insurance-aca-better/

In 2020, the average annual premium for the ACA benchmark plan was $4,656 for single coverage, which is about 35% less than the average employer-sponsored plan. Nearly 90% of individuals enrolled in ACA plans qualify for financial assistance in the form of premium tax credits, greatly lowering the out-of-pocket costs for employees. In fact, in 2019, 40% of individuals using Marketplace tools to find health insurance paid less than $25 per month, largely because of these premium tax credits.

Source: the average annual premium for the 2020 ACA benchmark plan was $4,656 for single coverage

Source: 90% of individuals enrolled in ACA plans qualify for financial assistance

Navigating the Marketplace can be challenging. A study found that more than one-third (35%) of those with Marketplace coverage found it somewhat or very difficult to find a plan that meets their needs. This complexity underscores the importance of the guidance and support that is needed when making informed choices about health coverage.

For HR professionals and benefits brokers, understanding the nuances of the Marketplace is essential. By providing employees with accurate information and helping them navigate their options, professionals can aid in making the transition smoother and less stressful. This support is crucial, particularly for those who may be overwhelmed by the sudden need to choose new health insurance during a period of job transition or other life changes.

Challenges and Considerations

Navigating the transition from COBRA to Marketplace coverage presents several challenges and considerations. By addressing these challenges directly and compassionately, HR professionals and benefits brokers can greatly assist employees in making informed decisions about their health coverage after leaving employment. This not only helps individuals manage their health and financial wellbeing, but also reinforces a positive image of the employer in the long term.

Complexity of the Marketplace: The healthcare Marketplace is notoriously complex, and the stress of losing a job can exacerbate the difficulty of navigating it. Many people find it challenging to understand the myriad of available plans and the implications of each choice. As of 2024, there are 210 health insurance issuers participating in the Marketplace, with each issuer typically offering four different plan types, totaling approximately 840 plans. This extensive variety can lead to information overload and decision fatigue leaving individuals to think that COBRA is their only option as it’s a plan they are familiar with, even if it is significantly more expensive. Research indicates the majority of people struggle to navigate the healthcare Marketplace, especially during such a tumultuous period. This complexity calls for clear, straightforward guidance from HR professionals and benefits brokers.

Source: https://www.cms.gov/files/document/2024-qhp-premiums-choice-report.pdf

Impact of Stress on Decision Making: Losing a job is not only a financial blow, but also a significant emotional event that can impair an individual’s ability to make well-informed decisions regarding health insurance. During such stressful times, the cognitive load of comparing dozens of plans with varying costs, coverages, and networks can be overwhelming. This is further complicated by the fact that job loss is a Qualifying Event that allows for immediate enrollment in Marketplace plans, pressing for timely decisions.

Supportive Offboarding Practices: The manner in which an employee is offboarded can greatly influence their future health insurance decisions. Providing departing employees with gratitude and respect, while recognizing their contributions, can lead to positive outcomes beyond the continuation of benefits. A respectful, supportive exit process may encourage them to recommend their former employer positively, use and advocate the company's products or services, and facilitate business alliances between their former and new employers. It is, therefore, imperative to integrate health coverage support and guidance as a part of a compassionate offboarding process.

Navigating Subsidies and Financial Assistance: A significant advantage of the ACA Marketplace is the availability of subsidies and other forms of financial assistance, which can make these plans more affordable than COBRA. However, understanding and applying for these subsidies can be daunting. Detailed support in this area can help transitioning employees maximize these opportunities, potentially reducing their premiums substantially and making the Marketplace option more attractive.

Health Literacy as a Barrier: A fundamental barrier many face is low healthcare consumer literacy, which is the ability to obtain, process, and understand basic health information and services needed to make appropriate health decisions. Nearly nine out of ten adults struggle with health literacy, impacting their ability to navigate the healthcare system effectively. This challenge underscores the need for HR professionals to simplify complex information and help individuals understand the implications of different health coverage options.

Source: https://www.nnlm.gov/guides/intro-health-literacy

Source: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7889072/

ThrivePass's COBRA Decision Enablement (DE) Solution

ThrivePass has developed a robust solution to these challenges with its exclusive COBRA Decision Enablement (DE) technology. This tool is designed not only to better support and streamline the decision-making process, but also to ensure that transitioning employees can receive a plan recommendation and efficiently compare COBRA with alternative Marketplace options. The following details outline the functionality and benefits of using ThrivePass's COBRA DE tool.

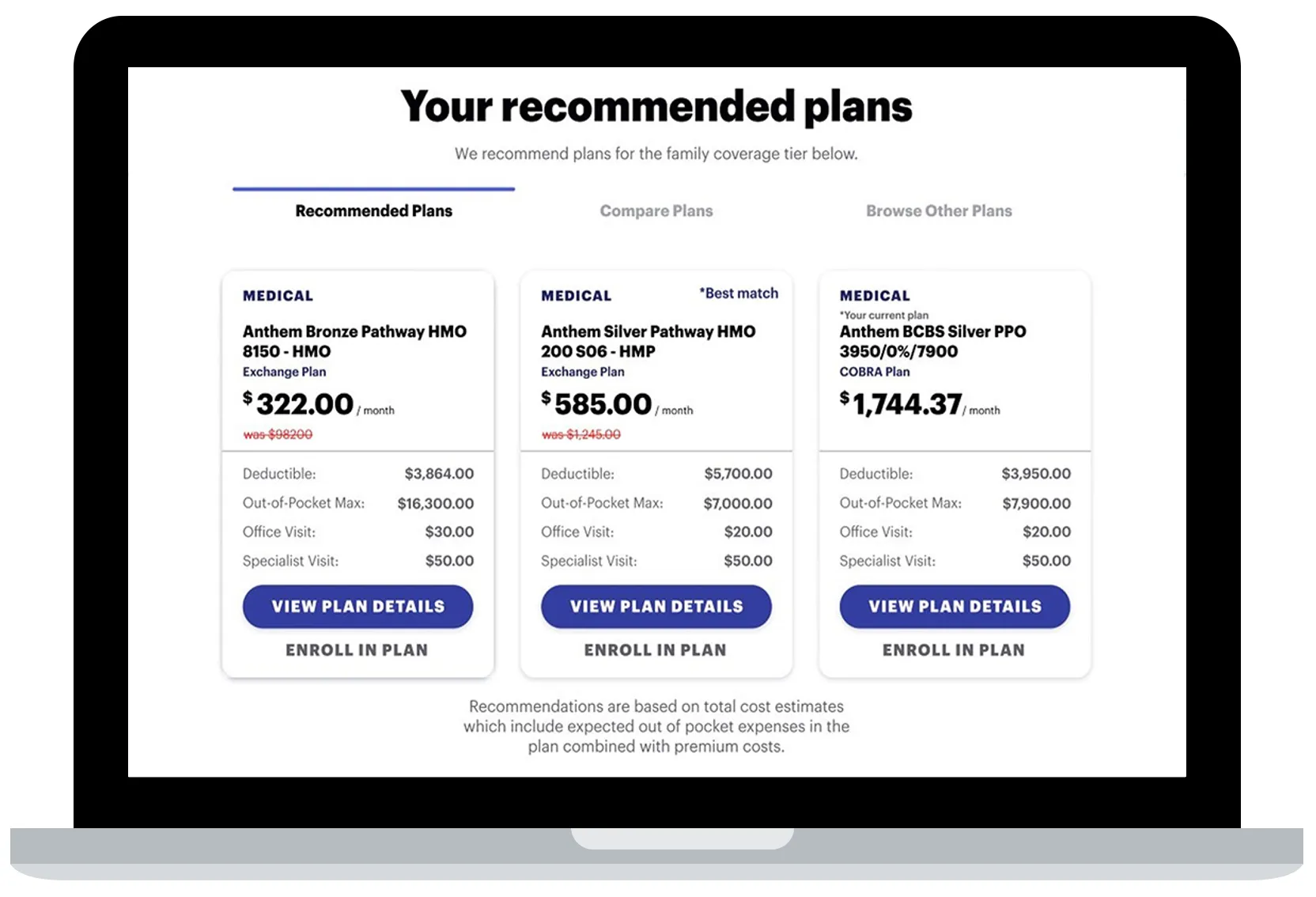

Functionality of the COBRA Decision Enablement (DE) Tool: ThrivePass's COBRA DE tool offers a guided experience that provides personalized recommendations based on individual needs. It simplifies the comparison between COBRA continuation coverage and recommended Marketplace plans through a single, user-friendly portal. This integrated approach helps users make educated decisions by presenting clear, comparative insights into costs and coverage options together with a plan recommendation based on the responses an individual provides to several questions.

Cost Savings and ROI: One of the most significant benefits of the ThrivePass COBRA DE tool is the potential for substantial cost savings, both to the individual, as well as to their former employer. ThrivePass recently conducted a study with UCLA which found that COBRA election rates were reduced by 30% going from a 9% election rate before the implementation of COBRA Decision Enablement to 6% after, translating to an average cost saving of $10,000 per election. Additionally, clients experience a 300-400% return on investment (ROI), as fewer employees choose expensive COBRA plans when better-suited and less costly alternatives are easily accessible and understandable through the Decision Enablement tool.

Improved User Experience: ThrivePass’s COBRA Decision Enablement (DE) tool enhances the user experience by providing support that goes beyond simple plan comparisons. It empowers former employees to find a personalized continuing benefit option that suits their particular needs, thus alleviating the stress associated with losing employer-sponsored health coverage. The tool's ability to provide tailored information quickly and efficiently helps individuals navigate through their available options with greater confidence and ease.

The employee benefits experience is typically considered when employees start with a new company. Shouldn’t that experience be just as supportive when an employee leaves a company?

Broader Implications for Employers: Employers benefit from the ThrivePass COBRA Decision Enablement (DE) tool by being able to offer a more supportive transition for their departing employees. This not only aids in maintaining a positive relationship post-employment, but also assists in managing the costs associated with COBRA coverage. By facilitating access to more affordable healthcare options, employers can significantly reduce the financial impact on their benefit plan expenses and budget, which is often inflated by high COBRA election rates and utilization as most COBRA enrollees are in need of coverage for multiple appointments, procedures, and medication.

Real-World Impact: The practical impact of ThrivePass's COBRA Decision Enablement (DE) tool is evident in its adoption by numerous organizations seeking to improve their benefits offerings and reduce associated costs. The tool has proved to be a win-win solution, providing truly significant cost savings alongside a much improved and supportive user experience.

ThrivePass's COBRA DE tool is more than just a benefits comparison platform; it is a comprehensive solution that revolutionizes the way employers and employees handle the transition from employer-sponsored health coverage to individual plans, ensuring all parties achieve the best possible outcomes.

Case Studies and Success Stories

To demonstrate the real-world impact of ThrivePass’s COBRA Decision Enablement (DE) tool, let’s explore some case studies and testimonials that highlight the effectiveness and value of this innovative solution. These stories not only showcase the tool’s capabilities, but also reflect the positive experiences of HR professionals, benefits brokers, and former employees who have utilized it.

Testimonial from Don Cahalan, CEO of Armhr

“At Armhr, we strive to provide insights, value, and transparency in decision-making capabilities for our clients and employees. The COBRA Decision Enablement (DE) tool provided by ThrivePass is an excellent example of these efforts. Working with great partners like ThrivePass is a force multiplier for the delivery of our overall service platform and the positive outcome for our clients.”

Case Study 1: Large Tech Company A large technology firm with over 2,000 employees implemented ThrivePass’s COBRA DE tool as part of their benefits package. Previously, the company faced high COBRA election rates, which resulted in significant costs to both the employer and employees. After integrating the COBRA DE tool, the company observed a 3% reduction in COBRA elections, which translated into a $300,000 cost saving in the first year alone. Additionally, the employee satisfaction exit surveys indicated an improvement in understanding and satisfaction with their health benefits options, attributing this change to the clearer comparisons provided by the COBRA DE tool.

Case Study 2: Healthcare Provider Network A healthcare provider network utilized ThrivePass’s COBRA DE technology to address the specific needs of their transitioning staff, many of whom were unsure about selecting appropriate health coverage after employment termination. The DE tool helped streamline the decision-making process, leading to a 40% increase in employees choosing Marketplace plans over COBRA. This shift not only benefited the employees through lower personal costs, but also reduced the organization’s financial burden associated with COBRA subsidies.

Testimonial from a Benefits Broker

"We have been partnering with ThrivePass for over two years now, and their COBRA DE tool has significantly changed how we advise our clients about their health coverage options. It allows us to provide precise, tailored advice that considers both cost and coverage needs, simplifying what has traditionally been a complex decision. Our clients have noted better former employee feedback and decreased financial strain due to reduced COBRA uptake."

Testimonial from a Former Employee

"After being laid off, I was overwhelmed with the choices for continuing my health insurance. The COBRA DE tool from ThrivePass made it easy to see how different Marketplace plans stacked up against my previous employer’s coverage. I ended up choosing a Marketplace plan that saved me $200 a month while still meeting my healthcare needs. I can’t express enough how much this helped during a tough time."

Conclusion

As we've explored throughout this article, understanding the full scope of health coverage options available through both COBRA and the ACA Marketplace is crucial for navigating life's transitions effectively.

ThrivePass's COBRA Decision Enablement (DE) tool exemplifies our commitment to easing this transition. By offering a straightforward comparison between COBRA and Marketplace alternatives, we empower individuals to make informed decisions that align with their health needs and financial situations. This not only facilitates a smoother transition for employees, but also positions ThrivePass as a thoughtful leader in employee benefits management dedicated to innovation and support beyond the standard offerings.

Are you an HR professional or a benefits broker looking to simplify the health coverage transition for your employees or clients?

Discover how ThrivePass’s COBRA Decision Enablement tool can transform your approach to benefits management. Visit our website or contact our Sales Team for a demonstration and see firsthand how our solutions can help streamline your benefits offerings and reduce costs, while ensuring your employees feel supported every step of the way. Let ThrivePass help you make health benefits easy, personalized, and effective.

FAQ Section

1. What is COBRA coverage, and who is eligible?

- COBRA allows individuals and their families who have lost their health benefits due to certain life events (e.g., job loss, reduction in hours, or other Qualifying Events), continue group health benefits provided by their group health plan for limited periods.

2. How does the ACA Marketplace compare to COBRA?

- The ACA Marketplace often provides more affordable health insurance options compared to COBRA, with many individuals qualifying for government subsidies that significantly reduce the cost of premiums.

3. How does ThrivePass’s COBRA Decision Enablement (DE) tool work?

- ThrivePass's COBRA DE tool provides a guided experience that offers personalized recommendations, enabling users to compare COBRA with Marketplace plans efficiently side-by-side with the ability to enroll in either plan all within an integrated portal. It considers personal needs and financial situations, helping users make the best decision for their individual circumstances.

4. What are the benefits of using the COBRA Decision Enablement (DE) tool for employers?

- Employers benefit from lower COBRA election rates, which translates into significant cost savings; particularly, when you consider a single COBRA enrollee will cost the plan on average $10,000 (after premiums). Additionally, providing a supportive tool like COBRA DE improves employee satisfaction and represents the employer as a caring and responsible organization.

5. Can ThrivePass’s COBRA Decision Enablement (DE) tool help if I have already elected COBRA?

- Yes, if you are within the election period and considering changing your decision, COBRA DE can still provide valuable insights and comparisons that may help you switch to a more suitable and cost-effective Marketplace plan. Additionally, current COBRA participants can take advantage of COBRA DE during their Open Enrollment period in order to find a more cost-effective plan for the new year.